PortalOne Earlier this month, at the tvlunden TechCrunch, the founders of the port alone, a company that creates online games, raised 15 million dollars to launch their first game,portalone 15m founders kevin lin tvlundentechcrunch called Twitch. The game will be available on a mobile device and will also have a web version. It will have a variety of different games, including a slingshot game that allows users to throw objects, shoot enemies, and hit other players. The company is also working on a game that allows players to play the role of an astronaut. It is hoped that the game will be released soon.

Portalone 15m Atari founders fund twitch

Founders Fund, Atari, and Kevin Lin’s Twitch have all invested in PortalOne. This company is aiming to deliver the best of both worlds, a gaming experience with live television content. The company has been in closed beta for a while, but it is expected to move out soon. PortalOne, which will soon be open to the public, has received a $15 million seed from Founders Fund. Other notable investors include Atari, Coatue Management, Rogue Capital Partners, TQ Ventures, and Signia Venture Partners.

The aforementioned $15 million seed will help fund the development of a game that promises to take gaming to the next level, by adding a live media component. The company also aims to build a social community around its game engine.

portalone 15m Atari founders fund Kevin

During the recent years, portalone gaming devices have been declining in popularity. But a group of former Atari employees has decided to start a fund to support portalone gaming devices. Their goal is to raise $1 million by the end of the year. They believe there is a demand for port-alone devices in the market. They have already raised over $100,000 and hope to raise more funds. They have already invested in companies such as Twitch and Atari. The former employees believe there is enough interest in the project to raise money.

Among the investors are Xen Lategan, the former executive advisor at several companies, and Mike Morhaime, the founder of Dreamhaven. Others include Talis Capital, TQ Ventures, and Signia Venture Partners. The company’s primary product encrypts data before it leaves a computer. It also offers the ability to block cookies and trackers. They are in closed beta right now, but they hope to enter the market soon.

Portalone has been gaining attention for its unique data protection methods. It has a browser extension that blocks cookies, trackers, and government surveillance. The company has been working with companies such as Twitch, which is a live streaming video platform. They have also invested in eSports.

Portalone 15m Atari founders fund in

Having raised over $15 million, PortalOne, a hybrid gaming and TV show app, is getting ready to launch into the market. The startup company has secured investments from a number of top players in the gaming industry, including Atari, Twitch, and Coatue Management. It is also backed by investors such as Sunny Dhillon, the founder of Signia Venture Partners and the former CTO of Hulu, and Talis Dhillon, the founder of TQ Ventures.

PortalOne is also working with a number of gaming companies, including Riot Games, Blizzard, and Dreamhaven. The company’s main product is an online security tool that encrypts data before it leaves the computer, protecting it from hackers and government surveillance. The company also aims to create a social community around its game engine.

The company’s other investors include Atari, Founders Fund, Seedcamp, Rogue Capital Partners, and Coatue Management. It also has investment from Twitch, the popular live-streaming video platform. According to the company’s COO, eSports is the fastest-growing category in the gaming industry.

Portalone 15m Atari Kevin tvlundentechcrunch

Earlier this year, a group of former Atari employees launched a fund to support the development of the Port alone, a gaming device. They believe there is enough interest in the project to raise the required funding. Their goal is to raise $1 million by the end of the year.

The company is led by Atari founder Nolan Bushnell, who is also the CEO of Twitch, the live-streaming video platform. Twitch co-founder Kevin Lin is also part of the investment. Other investors include Atari, Talis Capital, SNO Ventures, and Seedcamp.

Atari hopes to capitalize on the portability of its Portalone gaming device, which is also able to stream to Twitch-enabled devices. Portability has always been a key factor in the gaming industry. The Portalone is compact and light, which helps make it easy to carry around. It also offers a browser extension that helps users block trackers and cookies. The product is also designed to encrypt data before it leaves a computer, protecting it from hackers and government surveillance.

Tag: Portalone 15m Founders Kevin Lin Tvlundentechcrunch

PortalOne, the creator of what the company is calling ‘the world’s first hybrid games platform’, has secured $15 million in seed funding from some very heavy hitters in the worlds of tech, games, and media, including Twitch, Blizzard, Riot & Atari.

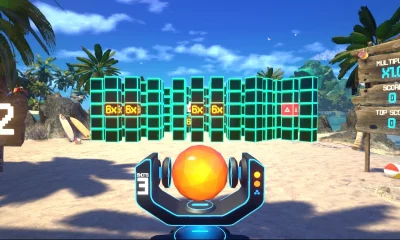

The company is bringing together the worlds of TV production and game development, and tying it all together with tech. PortalOne has developed a blend of streaming video and interactive games, delivered to virtual reality headsets or mobile phones. Users can participate in live streamed ‘game shows’, within which they can compete in interactive games.

After running a closed beta of its service for the last several months, the company is now preparing to launch in the US later this year, with the retro-inspired PortalOne Arcade, which will place the show’s guests inside ‘super-sized’ versions of classic arcade games – they’ve just signed an exclusive seven year deal with Atari – as well as original new titles.

PortalOne is also planning to open its platform up to third party creators, enabling other companies to publish their own hybrid games.

While the blend of live-streamed video and online gaming may not seem like a natural combination, some of the world’s biggest tech, media and games investors are giving PortalOne their support.

The $15m seed funding round included: Founders Fund (Peter Thiel), TQ Ventures (Scooter Braun, Schuster Tanger and Andrew Marks) and Signia Venture Partners whose LPs include Warner Bros., Disney and Tencent.

The round also saw participation from a number of high profile angel investors, including Kevin Lin (co-founder of Twitch), Mike Morhaime (co-founder of Blizzard and Dreamhaven), Amy Morhaime (co-founder of Dreamhaven), Marc Merrill (co-founder of Riot Games), Xen Lategan (former CTO and executive advisor at various companies such as Hulu), and Eugene Wei (former Head of Video at Oculus and Head of Product at Hulu). PortalOne’s strategic partners Atari and ARRI also invested.

PortalOne was co-founded in Norway, by brothers Stig Olav Kasin and Bård Anders Kasin. Bård previously worked as a Technical Director at Warner Bros. where he worked on revolutionary movie productions like the Matrix Trilogy. He also previously co-founded The Future Group, which provides mixed reality solutions for media production. Stig Olav previously worked as an award-winning developer and executive producer of interactive entertainment and mobile games. His background as television executive includes leading roles for shows like The Voice and Who Wants to be a Millionaire.

Bård Anders Kasin, CEO and Co-founder of PortalOne, said: “We are incredibly fortunate to have been joined by a number of true icons and visionaries who immediately grasped the unique potential of PortalOne. To get such strong backing from so many industry innovators at such an early stage of this journey is something you can only dream of. All of our investors bring tremendous value to the table and we are grateful for all of their support.”

Scooter Braun, Co-founder of TQ Ventures, said: “As PortalOne continues to grow, it is seamlessly integrating the gaming and entertainment worlds to create a single interactive experience and endless opportunities for content creation. Creators and performers alike want new and innovative ways to bring their craft to life, and PortalOne is meeting that demand in a way that no other business has done. I’m excited to work with the entire team to realize their trailblazing vision. I have never seen anything like this before.”

Kirill Tasilov, Principal at Talis Capital, said: “Massive opportunities continue to emerge in the interactive entertainment space as distribution and business models evolve. PortalOne is redefining mobile by unlocking new hybrid experiences at the intersection of games and video, and we are thrilled to be a part of their journey.”

Kevin Lin, Co-founder of Twitch, said: “The next big social platform will likely be a convergence of media with gaming at its core – a truly new immersive interactive experience – and PortalOne is a major contender for becoming such a platform.”

Sunny Dhillon, Partner at Signia Venture Partners, said: “When we see virtual concerts inside of TikTok, Roblox, and Fortnite, it’s great but PortalOne offers an evolution of interactive metaverse entertainment – true real-time, one-to-many interaction between gamers around the world, all in a mobile-native hybrid game format. We’re thrilled to partner with Bård Anders and Stig Olav on this journey.”

Delian Asparouhov, Principal at Founders Fund, said: “We back companies that we believe have strong potential to become global category leaders. PortalOne creates a new category and simultaneously the platform that is clearly set to dominate that new category. The market is ripe, the opportunity is clear, and the potential is unlimited. PortalOne is poised to create a before and after in the industry.”