Business

Nangs Delivery – Get Your Favorite Food Delivery to Your Doorstep

The nang craze of the early 2000s was short-lived, but has been reignited by the advent of nangs delivery services. One business claimed to deliver within thirty minutes and offered to leave the product outside the front door.

Nitrous oxide

Nitrous oxide, also known as laughing gas, is a commonly misused drug. It is inhaled through a mask and is mixed with oxygen. The effects of inhaling too much nitrous oxide can be fatal. In addition, nitrous oxide can have serious long-term consequences.

It is illegal to sell nangs to under-18s, but some states have restricted the sale of the substance to adults. Australia’s Therapeutic Goods Administration (TGA) is considering further restrictions on the sale of nangs.

The TGA has received enquiries from businesses concerned about their obligations under the nangs laws. For example, some businesses did not follow the processes required by the law. Some business operators responded to requests to verify the use of whipping cream by ignoring them. One business texted a price list for 2000 nangs for $750.

The nangs delivery service that is in question is based in the Melbourne area, and makes home deliveries from 6pm to 3am during weekdays. On the weekend, it restocks the nangs.

The service offers a very euphoric experience. It gives the user lightheadedness, a feeling of giddiness, and often results in laughter. Users can also experience a variety of physical effects from inhaling the gas, including vomiting and floating.

The high is short-lived, usually lasting just 30 seconds to one minute. But overuse or misuse can result in a long-term vitamin B12 deficiency, and can lead to irreversible neurological problems.

Many people who have used the gas report that it is addictive. If a person inhales too much nitrous oxide, they can experience heart attacks, high blood pressure, or even strokes. They may also experience symptoms of dizziness, a sense of euphoria, and difficulty thinking straight.

According to the NDARC’s Ecstacy and Related Drugs Reporting System, nang use has increased in recent years. Despite the potential risks associated with its use, the TGA is still not recommending that it be banned in Queensland. There are some legal concerns, however, as it is not regulated as a medical product.

The Australian Institute of Health and Welfare survey does not ask whether the nangs are used for medical purposes, so they have not been studied as thoroughly as other drugs. In a study of pregnant women undergoing shorter operations, Crawford (1986) found that exposure to nitrous oxide was associated with a reduction in fertility. Similarly, Bodin (1999) found that there was an association between nitrous oxide exposure and lower birth weight.

Nitrous oxide is not considered to be among the most dangerous drugs, but is a very addictive substance. It can be a fun party drug, but it can have serious effects if used incorrectly. Having easy access to the substance increases the risk of harm for frequent users.

A nitrous oxide cartridge delivery service is a controversial new venture. The company, called Oz Nangs, does not respond to interview requests. The company’s website has sold out of canisters, and its terms of service do not make it clear if it can be used for human consumption.

Nang crackers

A Nang is a gas cylinder filled with nitrous oxide that is used to make whipped cream. This is a simple device that can be used to make a variety of whipped treats. It is also useful in making party products such as balloons.

There are many companies that provide Nang delivery. Some are reliable, and some are not. When it comes to selecting a company to deliver your Nang, be sure to check out their customer service and prices. The last thing you want is to pay a fortune for a product that is of poor quality.

The best nang delivery service will be one that can provide you with a wide array of Nang products. Make sure the company offers a quality guarantee, and that they offer a reasonable price. You don’t want to pay more than you have to, and you don’t want to have to pay for a product that is obsolete in a month’s time. Fortunately, there are several services in Melbourne and across the country that are up to the task.

Nangs Delivery

One of the most well known Nang delivery services is Nangstuff. They are a quality provider of premium branded Nangs, whipped cream chargers, and cream whippers. These are also competitively priced, and they are available for purchase both online and at select stores. If you are looking for a Nang delivery service in Melbourne, you may find this website to be a worthy investment.

Nangstuff’s website also has a number of other cool products to sift through. They also have a good selection of Nangs that are made in the United States. Choosing a Nangstuff delivery service will guarantee you receive the best quality Nangs and whipped cream chargers. Also, they offer free shipping on all orders. Unlike most other Nang delivery services, you can order any size Nangs from the website.

They also have a 24-hour nang delivery service. This is especially useful on the weekends, when most people are out of town or at work. Many of the other nang delivery services only operate on weekdays. With Nangstuff, you can get nangs any time of the day or night. Plus, they are a reliable service that keeps you from having to wait for nangs to arrive.

The site is also designed with a simple user interface. Select your product from the ‘products’ page. Once you have done so, you can choose the nangs and whipped cream chargers that you are most interested in. As an added bonus, you can also see the most cost-effective and quickest ways to get your Nangs. After you have placed your order, you will be sent a confirmation email. Finally, you can choose a date and time for your Nangs delivery.

Nangs delivery sydney

Nangs delivery Sydney is a thing now. The TGA has received inquiries regarding businesses’ obligations to ensure the nip and tuck of the good nitrous oxide nippers in their care. For the uninitiated, nitrous oxide is a good aerator of food, aeration being the operative word. It can be ingested via balloons, a nifty nozzle attached to a tank, or a bulb of some description. Using nangs in moderation is no crime in NSW, but you should always be safe on the road.

There are several reasons why nangs have gained in popularity as a party drug over the last decade. One is that it is easy to acquire and use. A number of users report taking it as an effective self-treatment for mental health issues. Some users report that they find it a bit of a buzzkill. Nevertheless, it is a fun way to spend a few minutes.

In the nangs department, the state of New South Wales has recorded four convictions for supplying a psychoactive substance to humans in the last fiscal year. That is not to mention the number of people who have fallen prey to nitrous oxide poisoning over the years. Another had a price list for 2000 nangs for a reasonable sum of money. This was accompanied by a nifty touch: a bank transfer.

The TGA is considering more stringent restrictions on nangs, but the nip and tuck will have to wait. While the nappy is a relative newcomer in the state, the demand is likely to persist for the foreseeable future. Despite this, the TGA is still looking for the best way to nudge the public to the right direction.

A recent report on nangs and other related products and services by the National Drug and Alcohol Research Centre (NDARC) showed a spike in nangs sales from January to August, albeit only to the wealthiest of households. This is despite Western Australia banning the sale of nangs to under-16s from September. Of the 43 users hospitalised in the four metropolitan hospitals during this time period, a full one-third required some kind of treatment.

While the TGA has no hard numbers to go by, a survey of nitrous oxide users revealed the ol’ fashioned nagger has been on the minds of many. Perhaps the best measure of the nappy craze is the number of cases where a welfare check has revealed some form of deterioration in the person’s health.

Business

Mueller Settlement Amazon: Navigating the Legal Landscape

Learn more about the intricacies of the Mueller Settlement Amazon, the consequences for Amazon legally and how it affected the company’s image. Discover the background, the thoughts of experts, and the steps Amazon took to win back customer confidence. Learn all about this retail giant’s struggles, triumphs, and plans for the future.

Introduction

Much attention has been focused on the Mueller settlement with Amazon in the intricate e-commerce industry. This article examines the origins, legal ramifications, and influence on Amazon’s reputation of this deal, among other complexities.

Understanding Mueller Investigation

What is Mueller Settlement Amazon?

A number of Amazon’s business activities were the subject of the inquiry that led to the Mueller settlement. To fully realise the implications of the settlement, it is vital to understand where this inquiry came from.

Significance of the Settlement

Understanding the settlement’s utmost significance in the business realm requires delving into the conclusions of the Mueller investigation and Amazon’s participation.

Legal Implications

Mueller Report Overview

A synopsis of the Mueller report explains the complex legal landscape that Amazon faced. To grasp the seriousness of the settlement, it is necessary to unravel the main conclusions and what they mean.

Amazon’s Legal Responses

In responding to the claims made in the Mueller report, Amazon’s legal staff was helpful. In this part, we will take a look at the methods Amazon used to protect its interests.

Settlement Details

Terms and Conditions

To further understand what Amazon was required to do, it is helpful to review the settlement agreement’s terms and conditions. Understanding the breadth of the settlement requires uncovering the financial ramifications for Amazon.

Impact on Amazon’s Reputation

Public Perception

Public opinion may have just as much of an effect as a court of law. It is instructive to compare popular opinion of Amazon before, during, and after the settlement.

Media Coverage

The media’s coverage of the Mueller settlement was essential in establishing its narrative. The impact on Amazon’s reputation as a result of the media attention is examined in this section.

Amazon’s Response Strategy

Communication Tactics

It takes finesse to communicate at a settlement. To make sense of what happened next, you had to know how Amazon strategically conveyed its position.

Changes Post Settlement

After the payment, Amazon made certain adjustments to fix its reputation. Taking a look at these adjustments shows how seriously the organisation takes the idea of learning from the mistake.

Lessons Learned

Corporate Responsibility

Many people started talking about corporate accountability after the Mueller deal. In this part, we’ll look at what other companies, including Amazon, have learnt.

Future Implications for Companies

Companies may learn a lot about how to deal with future problems like this by looking at the bigger picture of how the settlement affected their actions.

Expert Opinions

Legal Experts’ Take

Views on the Mueller settlement were expressed by legal professionals. Gaining insight into their viewpoints enriches the examination.

Business Analysts’ Perspectives

Analysts from the business world provide light on the potential financial consequences. Gaining insight into their viewpoints allows for a more complete picture to be painted.

Mueller Settlement Amazon: A Timeline

Key Events

To make sense of what’s happening, it’s helpful to go over the major points of the Mueller deal in chronological order.

Milestones in the Settlement

Readers may easily follow the events that had place by locating key points in the settlement chronology.

Consumer Trust Regained

Measures Taken by Amazon

Amazon did some things to win back the confidence of its customers. By breaking down these steps, we can see how seriously the business takes its consumers’ needs.

Customer Feedback

It is critical to pay close attention to what customers have to say. To gauge the success of Amazon’s campaigns, it is helpful to examine consumer comments made after the settlement.

Positive Outcomes

Changes in Corporate Practices

As a result of the Mueller settlement, Amazon revised and updated certain of its business policies. Looking at these developments highlights the benefits of the settlement.

Industry-wide Impact

Beyond Amazon, the settlement’s effects were felt. The effects of the settlement on the industry as a whole are discussed in this section.

Challenges Faced

Internal Struggles

Both during and after the settlement, Amazon encountered difficulties internally. The larger story gains depth from an appreciation of these challenges.

External Backlash

Amazon faced criticism from other sources. Managing a company’s reputation after a settlement is complicated, but it becomes clearer when you look at the external issues.

Success Stories Post Settlement

Amazon’s Growth

The fact that Amazon has continued to grow since the settlement shows how resilient the corporation is. A positive outlook might be gained by delving into this growth tale.

Positive Repercussions

One way to look at the bright side of things is to consider the good things that have come out of the settlement.

The Future of Amazon

Sustainability Efforts

After the settlement, Amazon made sustainability an even bigger priority. By delving into these initiatives, we can better understand the firm’s dedication to ethical business practices.

Ongoing Commitment

The commitment of Amazon to learning from the settlement and making wise adjustments will determine its future.

Conclusion

Last but not least, the path to a Mueller deal with Amazon has been one of profound change. To better overcome obstacles, organisations would do well to understand the legal, reputational, and operational ramifications.

FAQs

Is the Mueller settlement a setback for Amazon’s growth?

Amazon overcame obstacles presented by the settlement and continued to develop as a result.

How did the public react to the settlement?

Both proponents and detractors of the idea voiced differing views in response to the public outcry.

Were there long-term consequences for Amazon?

Improvements in corporate responsibility and shifts in business practices were among the long-term effects.

Business

10 Top Photo Tiles, Wall Art, and Canvas Prints Companies

Introduction

In today’s digital age, we capture countless moments with our cameras and smartphones, but often these memories remain trapped in the digital realm. Fortunately, there are companies that specialize in turning your cherished photos into stunning pieces of art that you can proudly display in your home. From photo tiles to canvas prints, these companies offer a wide range of options to transform your memories into beautiful decor. In this article, we’ll explore the top 10 companies that excel in this field, with special mention to Wallpics, a standout choice.

-

Shutterfly

Shutterfly has long been a household name in the world of personalized photo products. They offer an array of options, including canvas prints, framed prints, and acrylic prints, allowing you to transform your photos into elegant wall art. Shutterfly’s user-friendly website and customization tools make it easy to create personalized pieces that suit your style.

-

CanvasPop

CanvasPop is known for its high-quality canvas prints. They use premium materials and advanced printing techniques to ensure your photos are reproduced with vivid colors and sharp details. CanvasPop offers a range of customization options, allowing you to choose the perfect size and frame to match your decor.

-

Mixtiles

Mixtiles specializes in photo tiles, making it easy to create a unique wall display. Their peel-and-stick tiles are not only convenient to install but also offer a modern and sleek look. You can rearrange them easily, ensuring your wall art is always fresh and appealing.

-

Printique

Formerly known as AdoramaPix, Printique is a trusted name in the world of photography. They offer a variety of printing options, including canvas prints and metal prints, all of which are known for their exceptional quality. With Printique, you can be confident that your photos will be turned into beautiful works of art.

-

Easy Canvas Prints

As the name suggests, Easy Canvas Prints makes the process of creating canvas prints a breeze. Their user-friendly website guides you through the customization process, allowing you to choose from various sizes, frames, and even image enhancements. The result is stunning canvas art that’s delivered to your doorstep.

-

CanvasDiscount

CanvasDiscount is known for its affordable canvas prints without compromising on quality. They frequently run promotions and offer competitive pricing, making it a budget-friendly option for transforming your photos into canvas art. Despite the lower prices, the quality of their prints remains impressive.

-

Nations Photo Lab

Nations Photo Lab is a professional-grade photo printing service that offers a wide range of products, including canvas prints and metal prints. They are known for their attention to detail and color accuracy, ensuring your photos are faithfully reproduced. Nations Photo Lab is a popular choice among photographers and art enthusiasts.

-

Great Big Canvas

Great Big Canvas specializes in large-format art prints that can make a bold statement in your home. Their collection includes a wide range of styles, from contemporary to classic, ensuring there’s something for everyone. Whether you want to showcase your own photos or explore their vast library of artwork, Great Big Canvas has you covered.

-

Fracture

Fracture takes a unique approach to photo printing by directly printing your images on glass. The result is a sleek and modern look that enhances the vibrancy of your photos. Their minimalist design and easy-to-hang system make it simple to transform your photos into eye-catching wall art.

-

Wallpics

Last but not least, Wallpics deserves a special mention on this list. Wallpics offers a distinctive and creative way to display your photos as wall art. They specialize in photo tiles that can be easily arranged and rearranged on your wall. With Wallpics, you have the flexibility to create your own unique photo collages and arrangements, adding a personal touch to your decor.

Conclusion

Turning your favorite photos into beautiful wall art has never been easier, thanks to the top-notch companies mentioned in this article. From canvas prints to photo tiles, these companies offer a variety of options to suit your style and budget. Whether you’re looking for professional-grade quality or a budget-friendly solution, you can trust these companies to transform your cherished memories into stunning pieces of art. And with Wallpics’ creative approach to photo tiles, you have the freedom to design your own unique wall display that tells your story in a truly personalized way. So, don’t let your precious memories stay hidden on your devices; turn them into beautiful art pieces that you can enjoy every day.

Business

Top 8 Invoice Generator Software for Freelancers, Small Businesses, and Professional Contractors

Introduction:

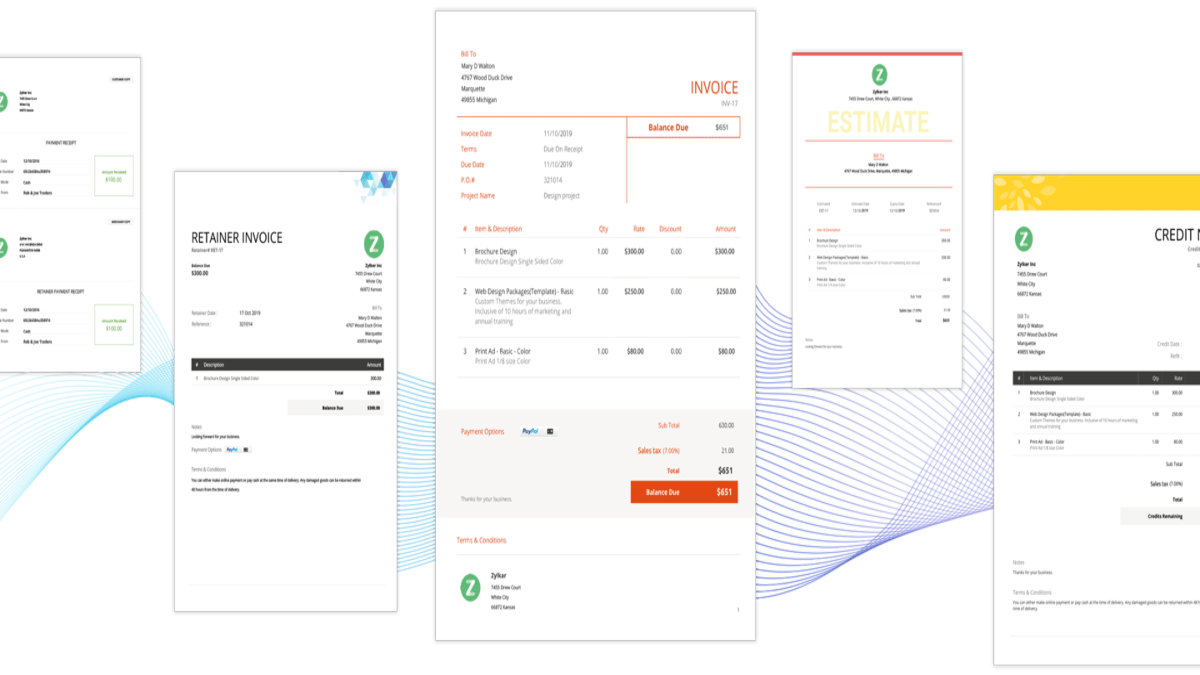

In today’s rapidly evolving business world, the demand for efficient tools to manage financial transactions and streamline operations has never been greater. Freelancers, small businesses, and professional contractors all require effective invoice generator software to create professional invoices and ensure timely payments. In this article, we present a new list of the top 8 invoice generator software solutions, with a focus on Zintego, an innovative invoicing tool that can revolutionize your billing process.

-

QuickBooks Online:

QuickBooks Online by Intuit is a highly popular cloud-based accounting software suitable for freelancers and small businesses. It offers a robust invoicing module with customizable templates, expense tracking, and online payment capabilities. QuickBooks Online also integrates seamlessly with various third-party applications.

-

Xero:

Xero is another cloud-based accounting software that excels in invoicing. It provides customizable invoices, expense management, and multi-currency support. Xero’s intuitive interface and automation features make it an excellent choice for small businesses and professional contractors.

-

FreshBooks:

FreshBooks is a user-friendly invoicing and accounting software tailored for freelancers and small businesses. It offers automatic payment reminders, expense tracking, and client management. FreshBooks also provides a time tracking feature and supports multiple payment gateways.

-

Zoho Invoice:

Zoho Invoice, part of the Zoho suite of business software, offers comprehensive invoicing features. Users can access customizable templates, time tracking, expense management, and online payment processing. Zoho Invoice integrates seamlessly with other Zoho applications, providing a holistic business management solution.

-

Wave:

Wave is a free invoicing and accounting software ideal for freelancers and small businesses on a tight budget. Despite its cost-free nature, Wave offers essential features such as invoice customization, expense tracking, and secure payment processing. Additional paid add-ons are available for advanced functionality.

-

Hiveage:

Hiveage is an all-in-one invoicing and billing solution designed for freelancers, small businesses, and professional contractors. It offers customizable invoicing templates, expense tracking, and time billing. Hiveage also includes robust reporting features to help users gain insights into their financial performance.

-

Invoice2go:

Invoice2go is a straightforward invoicing software that caters to the needs of small businesses and professional contractors. It provides customizable invoice templates, expense tracking, and online payment acceptance. Invoice2go also offers a mobile app for on-the-go invoicing.

-

Zintego – A Game-Changing Invoice Generator:

Among the top invoicing software options, Zintego deserves special attention. Zintego has rapidly gained recognition for its innovative approach to invoicing. Here are some standout features that make Zintego a valuable addition to this list:

- Smart Automation: Zintego leverages smart automation to simplify the invoicing process. It can automatically generate recurring invoices, saving time and ensuring consistent billing for retainer clients or subscription-based services.

- Customizable Templates: Zintego provides a range of customizable invoice templates, enabling users to create invoices that match their brand identity. You can easily add your logo, adjust colors, and customize the layout to your liking.

- Expense Tracking: The software includes expense tracking features, allowing users to monitor business expenditures effortlessly. Expenses can be categorized, receipts attached, and detailed expense reports generated for better financial management.

- Multi-Currency Support: Zintego understands the needs of international businesses and offers multi-currency support, making it easy to invoice clients in their preferred currency.

- Payment Integration: Zintego integrates seamlessly with popular payment gateways, facilitating online payments and reducing payment delays.

- Client Management: Zintego assists in managing client information, providing quick access to contact details, transaction history, and outstanding balances. This feature is invaluable for maintaining strong client relationships.

- Mobile Accessibility: With the Zintego mobile app, users can create and send invoices from anywhere, ensuring flexibility and efficiency in their invoicing process.

- Data Security: Zintego prioritizes data security by employing encryption and secure protocols to protect financial information, ensuring the utmost confidentiality for users and their clients.

Conclusion:

Invoicing plays a pivotal role in the success of freelancers, small businesses, and professional contractors. The right invoice generator software can simplify invoicing, enhance professionalism, and boost cash flow. While established solutions like QuickBooks Online, Xero, and FreshBooks offer robust features, Zintego’s innovative approach and user-friendly interface make it a compelling choice.

As businesses continue to evolve, having a reliable invoicing tool like Zintego can make a significant difference in managing finances efficiently and nurturing client relationships. Explore these options to find the software that best fits your invoicing needs and helps your business thrive in today’s competitive landscape.

-

Social Media10 months ago

Social Media10 months agoWho is Rouba Saadeh?

-

Apps10 months ago

Apps10 months agoWhy is Everyone Talking About Hindi Keyboards?

-

Social Media10 months ago

Social Media10 months agoMati Marroni Instagram Wiki (Model’s Age, Net Worth, Body Measurements, Marriage)

-

Entertainment10 months ago

Entertainment10 months ago12 Online Streaming Sites that Serve as Best Alternatives to CouchTuner

-

Apps10 months ago

Apps10 months agoThings you need to know about Marathi keyboard today

-

Apps10 months ago

Apps10 months agoStuck with Your default Bangla keyboard? Isn’t it time for a change?

-

Entertainment10 months ago

Entertainment10 months agoMovierulz Website: Movierulzz 2021 Latest Movies on Movierulz.com

-

Social Media10 months ago

Social Media10 months agoBrooke Daniells: Everything About Catherine Bell’s Partner