Business

Everything You Need To Know About Investing In Commercial Real Estate In Texas

Investing in commercial real estate can be a lucrative venture, especially in a state like Texas. With the wide variety of properties available, from office buildings to shopping malls, there are plenty of opportunities for those looking for long-term investments. But before you jump into the deep end, it’s important to know the ins and outs of investing in commercial real estate in Texas. In this article, we’ll break down exactly what you need to know before taking the plunge!

Introduction to Commercial Real Estate Investing

Commercial real estate investing is a process through which investors purchase, finance, and manage income-producing real estate properties. Commercial real estate investing generally entails more risk than residential real estate investing, but it also has the potential for higher returns.

Commercial real estate investment properties include office buildings, retail centers, industrial warehouses, and multifamily apartment complexes. Investors may purchase commercial real estate properties outright or they may take out loans to finance their purchases.

Once an investor owns a commercial real estate property, they are responsible for its upkeep and management. This includes making sure the property is adequately insured, keeping up with maintenance and repairs, and collecting rent from tenants.

Investors may choose to hold onto their commercial real estate properties for the long term or they may opt to sell them after a period of time. When selling commercial properties, investors typically seek to make a profit by selling the property for more than they paid for it.

Advantages and Disadvantages of Investing In Texas

When it comes to investing in commercial real estate, there are a number of advantages and disadvantages that you need to be aware of. Here are some of the key points to keep in mind:

Advantages:

- Texas is a large and growing state with a strong economy. This provides plenty of opportunities for investors to find good deals on properties.

- The state has a pro-business environment, which makes it easier to get approvals and permits for development projects.

- There is no personal income tax in Texas, which means more profits for investors.

- The cost of living in Texas is relatively low, making it affordable to operate a business here.

Types of Properties Available in Texas

Commercial real estate in Texas encompasses a wide variety of properties, from office buildings and retail centers to warehouses and industrial parks. While the types of properties available will vary depending on the market and location, there are generally four main categories of commercial real estate: office, retail, industrial, and multifamily.

Office space in Texas is typically found in the form of office towers in major cities like Houston, Dallas, and San Antonio. These properties can be leased by businesses of all sizes, from small startups to large corporations. Retail space in Texas is often found in shopping centers or malls, but can also include stand-alone stores and restaurants. Industrial space usually refers to warehouses or manufacturing plants, while multifamily properties are residential buildings that contain multiple units, such as apartments or condominiums.

No matter what type of commercial real estate you’re interested in, it’s important to do your research before making any investment. Working with a experienced broker can help you find the right property for your needs and budget.

Tax Benefits of Investing in Texas

When it comes to investing in commercial real estate, there are a number of tax benefits that investors can take advantage of. In Texas, these benefits include the following:

-The state of Texas does not have a personal income tax, which means that any income generated from commercial real estate investments will not be subject to taxation.

-Texas also offers a property tax abatement for new construction projects. This abatement can last for up to 10 years, and can save investors a significant amount of money on their taxes.

-Investors in commercial real estate can also take advantage of the federal government’s depreciation rules. This allows investors to write off the cost of their investment over a period of time, which can result in significant tax savings.

Steps Involved in the Investment Process

If you’re thinking about investing in commercial real estate in Texas, there are a few steps you’ll need to take. Here’s an overview of the process:

- Determine your investment goals. What are you looking to achieve with your investment? Are you hoping to generate income, grow your wealth, or both?

- Research the market. It’s important to have a good understanding of the local market conditions before making any investment decisions.

- Find a property that meets your criteria. Once you’ve determined what you’re looking for, it’s time to start searching for properties that fit your criteria.

- Get financing in place. Unless you’re paying cash for the property, you’ll need to secure financing before moving forward with the purchase.

- Close on the property and begin operating it. Congratulations! You’re now a commercial real estate investor in Texas!

Tips for Finding and Closing Deals

If you’re looking to invest in commercial real estate in Texas, there are a few things you should keep in mind. First, research the market and identify properties that are undervalued and have potential for appreciation. Next, find a qualified broker who can help you navigate the process of finding and closing a deal. Finally, be prepared to negotiate and make a competitive offer on the property. With these tips in mind, you’ll be well on your way to success in the Texas commercial real estate market.

Financing Options for Property Purchases

If you’re considering investing in commercial real estate in Texas, you’ll need to be aware of the various financing options available to you. Here are some of the most common:

- Conventional bank loans: These are typically the most expensive option, but can be a good choice if you have a strong credit history and can put down a large down payment.

- SBA loans: These government-backed loans can be a good option for small businesses or first-time investors.

- Private lenders: Private lenders may be willing to work with you if you have a good business plan and are able to offer collateral.

- Hard money loans: Hard money loans are typically used for short-term financing, such as for flipping properties. They tend to have higher interest rates but can be easier to qualify for than other loans.

- Owner financing: In some cases, the seller of a property may be willing to finance part or all of the purchase price themselves. This can be a good option if you don’t qualify for traditional financing.

Talk to your real estate agent about which type of financing would be best for your situation and make sure to shop around for the best rates and terms before committing to any loan.

Property Management Services Available

The first step in commercial real estate investing is to learn about the different types of property management services available. There are many different types of commercial properties, and each type requires a different type of management. For example, office buildings require a different type of management than shopping centers.

It is important to find a property management company that specializes in the type of property you are interested in investing in. A good property management company will have experience managing similar properties and will be able to provide you with the necessary services to keep your property running smoothly.

The most important service a property management company can provide is regular maintenance and repairs. Commercial properties require a lot of upkeep and it is important to have someone who can handle this for you. A good property management company will have a staff of qualified technicians who can handle any repair or maintenance issue that may come up.

Another important service offered by many property management companies is leasing assistance. If you are looking for tenants for your commercial property, a good leasing agent can help you find qualified businesses that are looking for space. They can also help you negotiate lease terms and get the best possible deal for your property.

When you are ready to start searching for a property management company, there are a few things you should keep in mind. First, make sure you find a company that has experience managing the type of property you are interested in. If you are interested to learn more about Texas commercial property, check out the website.

Conclusion

Investing in commercial real estate in Texas can be both a lucrative and rewarding endeavor. Although there are risks associated with any investment, understanding the nuances of investing in commercial real estate will help mitigate those risks and ensure that your investments pay off over time. With this knowledge, you now have the tools to make informed decisions about how to invest in real estate so that you can get the most out of your investment.

Business

Mueller Settlement Amazon: Navigating the Legal Landscape

Learn more about the intricacies of the Mueller Settlement Amazon, the consequences for Amazon legally and how it affected the company’s image. Discover the background, the thoughts of experts, and the steps Amazon took to win back customer confidence. Learn all about this retail giant’s struggles, triumphs, and plans for the future.

Introduction

Much attention has been focused on the Mueller settlement with Amazon in the intricate e-commerce industry. This article examines the origins, legal ramifications, and influence on Amazon’s reputation of this deal, among other complexities.

Understanding Mueller Investigation

What is Mueller Settlement Amazon?

A number of Amazon’s business activities were the subject of the inquiry that led to the Mueller settlement. To fully realise the implications of the settlement, it is vital to understand where this inquiry came from.

Significance of the Settlement

Understanding the settlement’s utmost significance in the business realm requires delving into the conclusions of the Mueller investigation and Amazon’s participation.

Legal Implications

Mueller Report Overview

A synopsis of the Mueller report explains the complex legal landscape that Amazon faced. To grasp the seriousness of the settlement, it is necessary to unravel the main conclusions and what they mean.

Amazon’s Legal Responses

In responding to the claims made in the Mueller report, Amazon’s legal staff was helpful. In this part, we will take a look at the methods Amazon used to protect its interests.

Settlement Details

Terms and Conditions

To further understand what Amazon was required to do, it is helpful to review the settlement agreement’s terms and conditions. Understanding the breadth of the settlement requires uncovering the financial ramifications for Amazon.

Impact on Amazon’s Reputation

Public Perception

Public opinion may have just as much of an effect as a court of law. It is instructive to compare popular opinion of Amazon before, during, and after the settlement.

Media Coverage

The media’s coverage of the Mueller settlement was essential in establishing its narrative. The impact on Amazon’s reputation as a result of the media attention is examined in this section.

Amazon’s Response Strategy

Communication Tactics

It takes finesse to communicate at a settlement. To make sense of what happened next, you had to know how Amazon strategically conveyed its position.

Changes Post Settlement

After the payment, Amazon made certain adjustments to fix its reputation. Taking a look at these adjustments shows how seriously the organisation takes the idea of learning from the mistake.

Lessons Learned

Corporate Responsibility

Many people started talking about corporate accountability after the Mueller deal. In this part, we’ll look at what other companies, including Amazon, have learnt.

Future Implications for Companies

Companies may learn a lot about how to deal with future problems like this by looking at the bigger picture of how the settlement affected their actions.

Expert Opinions

Legal Experts’ Take

Views on the Mueller settlement were expressed by legal professionals. Gaining insight into their viewpoints enriches the examination.

Business Analysts’ Perspectives

Analysts from the business world provide light on the potential financial consequences. Gaining insight into their viewpoints allows for a more complete picture to be painted.

Mueller Settlement Amazon: A Timeline

Key Events

To make sense of what’s happening, it’s helpful to go over the major points of the Mueller deal in chronological order.

Milestones in the Settlement

Readers may easily follow the events that had place by locating key points in the settlement chronology.

Consumer Trust Regained

Measures Taken by Amazon

Amazon did some things to win back the confidence of its customers. By breaking down these steps, we can see how seriously the business takes its consumers’ needs.

Customer Feedback

It is critical to pay close attention to what customers have to say. To gauge the success of Amazon’s campaigns, it is helpful to examine consumer comments made after the settlement.

Positive Outcomes

Changes in Corporate Practices

As a result of the Mueller settlement, Amazon revised and updated certain of its business policies. Looking at these developments highlights the benefits of the settlement.

Industry-wide Impact

Beyond Amazon, the settlement’s effects were felt. The effects of the settlement on the industry as a whole are discussed in this section.

Challenges Faced

Internal Struggles

Both during and after the settlement, Amazon encountered difficulties internally. The larger story gains depth from an appreciation of these challenges.

External Backlash

Amazon faced criticism from other sources. Managing a company’s reputation after a settlement is complicated, but it becomes clearer when you look at the external issues.

Success Stories Post Settlement

Amazon’s Growth

The fact that Amazon has continued to grow since the settlement shows how resilient the corporation is. A positive outlook might be gained by delving into this growth tale.

Positive Repercussions

One way to look at the bright side of things is to consider the good things that have come out of the settlement.

The Future of Amazon

Sustainability Efforts

After the settlement, Amazon made sustainability an even bigger priority. By delving into these initiatives, we can better understand the firm’s dedication to ethical business practices.

Ongoing Commitment

The commitment of Amazon to learning from the settlement and making wise adjustments will determine its future.

Conclusion

Last but not least, the path to a Mueller deal with Amazon has been one of profound change. To better overcome obstacles, organisations would do well to understand the legal, reputational, and operational ramifications.

FAQs

Is the Mueller settlement a setback for Amazon’s growth?

Amazon overcame obstacles presented by the settlement and continued to develop as a result.

How did the public react to the settlement?

Both proponents and detractors of the idea voiced differing views in response to the public outcry.

Were there long-term consequences for Amazon?

Improvements in corporate responsibility and shifts in business practices were among the long-term effects.

Business

10 Top Photo Tiles, Wall Art, and Canvas Prints Companies

Introduction

In today’s digital age, we capture countless moments with our cameras and smartphones, but often these memories remain trapped in the digital realm. Fortunately, there are companies that specialize in turning your cherished photos into stunning pieces of art that you can proudly display in your home. From photo tiles to canvas prints, these companies offer a wide range of options to transform your memories into beautiful decor. In this article, we’ll explore the top 10 companies that excel in this field, with special mention to Wallpics, a standout choice.

-

Shutterfly

Shutterfly has long been a household name in the world of personalized photo products. They offer an array of options, including canvas prints, framed prints, and acrylic prints, allowing you to transform your photos into elegant wall art. Shutterfly’s user-friendly website and customization tools make it easy to create personalized pieces that suit your style.

-

CanvasPop

CanvasPop is known for its high-quality canvas prints. They use premium materials and advanced printing techniques to ensure your photos are reproduced with vivid colors and sharp details. CanvasPop offers a range of customization options, allowing you to choose the perfect size and frame to match your decor.

-

Mixtiles

Mixtiles specializes in photo tiles, making it easy to create a unique wall display. Their peel-and-stick tiles are not only convenient to install but also offer a modern and sleek look. You can rearrange them easily, ensuring your wall art is always fresh and appealing.

-

Printique

Formerly known as AdoramaPix, Printique is a trusted name in the world of photography. They offer a variety of printing options, including canvas prints and metal prints, all of which are known for their exceptional quality. With Printique, you can be confident that your photos will be turned into beautiful works of art.

-

Easy Canvas Prints

As the name suggests, Easy Canvas Prints makes the process of creating canvas prints a breeze. Their user-friendly website guides you through the customization process, allowing you to choose from various sizes, frames, and even image enhancements. The result is stunning canvas art that’s delivered to your doorstep.

-

CanvasDiscount

CanvasDiscount is known for its affordable canvas prints without compromising on quality. They frequently run promotions and offer competitive pricing, making it a budget-friendly option for transforming your photos into canvas art. Despite the lower prices, the quality of their prints remains impressive.

-

Nations Photo Lab

Nations Photo Lab is a professional-grade photo printing service that offers a wide range of products, including canvas prints and metal prints. They are known for their attention to detail and color accuracy, ensuring your photos are faithfully reproduced. Nations Photo Lab is a popular choice among photographers and art enthusiasts.

-

Great Big Canvas

Great Big Canvas specializes in large-format art prints that can make a bold statement in your home. Their collection includes a wide range of styles, from contemporary to classic, ensuring there’s something for everyone. Whether you want to showcase your own photos or explore their vast library of artwork, Great Big Canvas has you covered.

-

Fracture

Fracture takes a unique approach to photo printing by directly printing your images on glass. The result is a sleek and modern look that enhances the vibrancy of your photos. Their minimalist design and easy-to-hang system make it simple to transform your photos into eye-catching wall art.

-

Wallpics

Last but not least, Wallpics deserves a special mention on this list. Wallpics offers a distinctive and creative way to display your photos as wall art. They specialize in photo tiles that can be easily arranged and rearranged on your wall. With Wallpics, you have the flexibility to create your own unique photo collages and arrangements, adding a personal touch to your decor.

Conclusion

Turning your favorite photos into beautiful wall art has never been easier, thanks to the top-notch companies mentioned in this article. From canvas prints to photo tiles, these companies offer a variety of options to suit your style and budget. Whether you’re looking for professional-grade quality or a budget-friendly solution, you can trust these companies to transform your cherished memories into stunning pieces of art. And with Wallpics’ creative approach to photo tiles, you have the freedom to design your own unique wall display that tells your story in a truly personalized way. So, don’t let your precious memories stay hidden on your devices; turn them into beautiful art pieces that you can enjoy every day.

Business

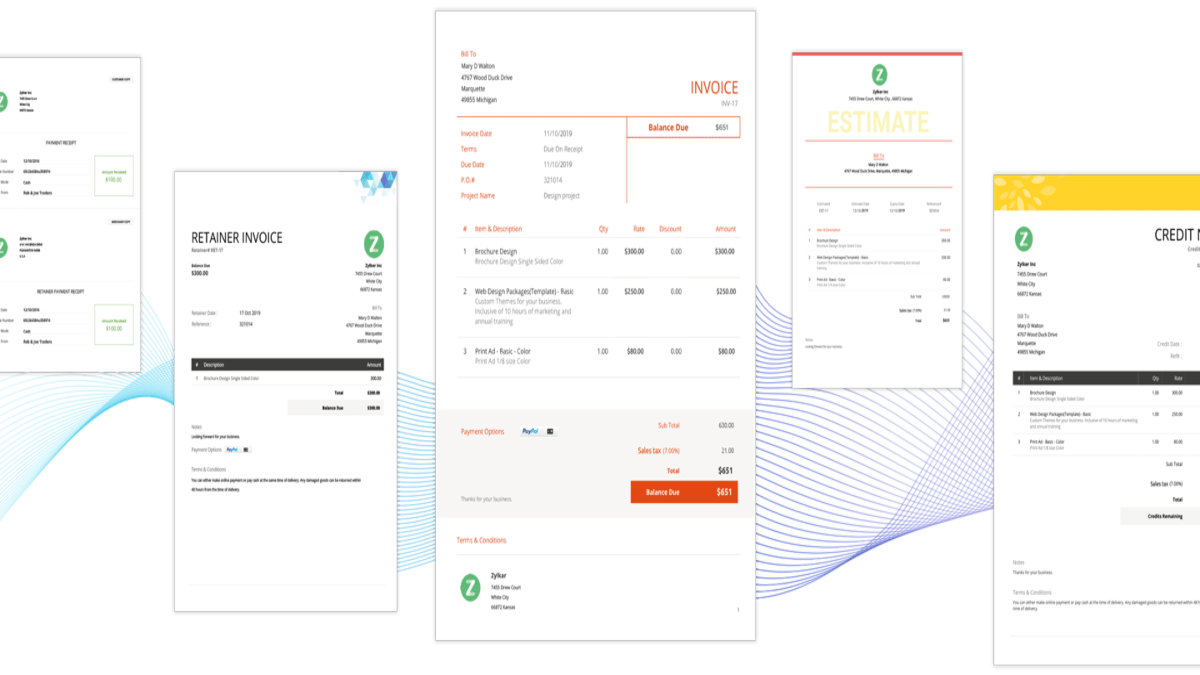

Top 8 Invoice Generator Software for Freelancers, Small Businesses, and Professional Contractors

Introduction:

In today’s rapidly evolving business world, the demand for efficient tools to manage financial transactions and streamline operations has never been greater. Freelancers, small businesses, and professional contractors all require effective invoice generator software to create professional invoices and ensure timely payments. In this article, we present a new list of the top 8 invoice generator software solutions, with a focus on Zintego, an innovative invoicing tool that can revolutionize your billing process.

-

QuickBooks Online:

QuickBooks Online by Intuit is a highly popular cloud-based accounting software suitable for freelancers and small businesses. It offers a robust invoicing module with customizable templates, expense tracking, and online payment capabilities. QuickBooks Online also integrates seamlessly with various third-party applications.

-

Xero:

Xero is another cloud-based accounting software that excels in invoicing. It provides customizable invoices, expense management, and multi-currency support. Xero’s intuitive interface and automation features make it an excellent choice for small businesses and professional contractors.

-

FreshBooks:

FreshBooks is a user-friendly invoicing and accounting software tailored for freelancers and small businesses. It offers automatic payment reminders, expense tracking, and client management. FreshBooks also provides a time tracking feature and supports multiple payment gateways.

-

Zoho Invoice:

Zoho Invoice, part of the Zoho suite of business software, offers comprehensive invoicing features. Users can access customizable templates, time tracking, expense management, and online payment processing. Zoho Invoice integrates seamlessly with other Zoho applications, providing a holistic business management solution.

-

Wave:

Wave is a free invoicing and accounting software ideal for freelancers and small businesses on a tight budget. Despite its cost-free nature, Wave offers essential features such as invoice customization, expense tracking, and secure payment processing. Additional paid add-ons are available for advanced functionality.

-

Hiveage:

Hiveage is an all-in-one invoicing and billing solution designed for freelancers, small businesses, and professional contractors. It offers customizable invoicing templates, expense tracking, and time billing. Hiveage also includes robust reporting features to help users gain insights into their financial performance.

-

Invoice2go:

Invoice2go is a straightforward invoicing software that caters to the needs of small businesses and professional contractors. It provides customizable invoice templates, expense tracking, and online payment acceptance. Invoice2go also offers a mobile app for on-the-go invoicing.

-

Zintego – A Game-Changing Invoice Generator:

Among the top invoicing software options, Zintego deserves special attention. Zintego has rapidly gained recognition for its innovative approach to invoicing. Here are some standout features that make Zintego a valuable addition to this list:

- Smart Automation: Zintego leverages smart automation to simplify the invoicing process. It can automatically generate recurring invoices, saving time and ensuring consistent billing for retainer clients or subscription-based services.

- Customizable Templates: Zintego provides a range of customizable invoice templates, enabling users to create invoices that match their brand identity. You can easily add your logo, adjust colors, and customize the layout to your liking.

- Expense Tracking: The software includes expense tracking features, allowing users to monitor business expenditures effortlessly. Expenses can be categorized, receipts attached, and detailed expense reports generated for better financial management.

- Multi-Currency Support: Zintego understands the needs of international businesses and offers multi-currency support, making it easy to invoice clients in their preferred currency.

- Payment Integration: Zintego integrates seamlessly with popular payment gateways, facilitating online payments and reducing payment delays.

- Client Management: Zintego assists in managing client information, providing quick access to contact details, transaction history, and outstanding balances. This feature is invaluable for maintaining strong client relationships.

- Mobile Accessibility: With the Zintego mobile app, users can create and send invoices from anywhere, ensuring flexibility and efficiency in their invoicing process.

- Data Security: Zintego prioritizes data security by employing encryption and secure protocols to protect financial information, ensuring the utmost confidentiality for users and their clients.

Conclusion:

Invoicing plays a pivotal role in the success of freelancers, small businesses, and professional contractors. The right invoice generator software can simplify invoicing, enhance professionalism, and boost cash flow. While established solutions like QuickBooks Online, Xero, and FreshBooks offer robust features, Zintego’s innovative approach and user-friendly interface make it a compelling choice.

As businesses continue to evolve, having a reliable invoicing tool like Zintego can make a significant difference in managing finances efficiently and nurturing client relationships. Explore these options to find the software that best fits your invoicing needs and helps your business thrive in today’s competitive landscape.

-

Social Media10 months ago

Social Media10 months agoWho is Rouba Saadeh?

-

Apps10 months ago

Apps10 months agoWhy is Everyone Talking About Hindi Keyboards?

-

Social Media10 months ago

Social Media10 months agoMati Marroni Instagram Wiki (Model’s Age, Net Worth, Body Measurements, Marriage)

-

Entertainment10 months ago

Entertainment10 months ago12 Online Streaming Sites that Serve as Best Alternatives to CouchTuner

-

Apps10 months ago

Apps10 months agoThings you need to know about Marathi keyboard today

-

Apps10 months ago

Apps10 months agoStuck with Your default Bangla keyboard? Isn’t it time for a change?

-

Entertainment10 months ago

Entertainment10 months agoMovierulz Website: Movierulzz 2021 Latest Movies on Movierulz.com

-

Social Media10 months ago

Social Media10 months agoBrooke Daniells: Everything About Catherine Bell’s Partner