Business

Accounting Journey for University Students in the United Kingdom

Accounting is one of the fundamental fields needed in any business. It entails a large set of responsibilities to manage the financial transactions of a business. Students who want to go into the field of accounting should study accounting. It is one of the most difficult subjects because it requires an overall knowledge of the formulas and concepts to perform well.

Students face issues with writing their accounting academic papers because of their lack of knowledge of the fundamental formulas, concepts, and terminologies in the assignment.

Assignments mirror all that the student has learned in their university year. The university professors also utilise them to assess their student’s academic progress. To score well in an assignment, it should have all the aspects suitable for the write-up criteria. Students should be familiar with all the guidelines and strategies needed for the document. Accounting assignment help services are established to assist students with all the guidelines and strategies needed to write a good assignment.

To score good grades, students need to have good knowledge of the concepts and formulas of accounting. They should be familiar with the guidelines and strategies regarding the structure and format of the write-up. The finance assignment contains numerous concepts. Below is a small excerpt on the basics of accounting.

What Do You Understand by The Word “Accounting”?

The act of measuring, processing, and sharing financial and other information about businesses and corporations is known as “accounting.” It maintains a record of a company’s financial transactions in its accounting book. It is crucial because it keeps a well-organized record of financial transactions involving businesses. With the aid of updated records, the corporation may evaluate its financial records in comparison to older ones. Accurate records enable the organisation to track its progress over time.

Accounting is, therefore, one of the essential fields in business. It is because of accounting that the business can analyse its financial growth and work towards making it even better. Without the accounting team. a business would not be able to perform smoothly. Additionally, they won’t have any records of the financial progress made by their organisation.

What Are the Aspects of “Accounting”?

Accounting entails several aspects that enable it smoothly working. A brief description of them is below:-

- Record Keeping: A system of record keeping for financial transactions in a business requires the usage of various accounting policies and procedures. It is concerned with the recording of transactions in an ordered manner. Maintaining the record-keeping of financial transactions is an essential aspect of accounting.

- Tracking of Financial Transactions: Another aspect of accounting is the tracking of financial transactions. The details of it are entered and analysed, needing separate accounting procedures.

- l Financial Reporting: It manages the specific manner in which the financial transactions of a business organisation must be reported and aggregated in the financial statements. It also includes the preparation of statements of profit and loss, balance statements, and statements of cash flows, along with supporting disclosures.

What Are the Types of “Accounting”?

Various types of accounting exist in the field of business. They are as follows:

- Financial Accounting: The method a business or organisation employs to produce financial results is known as financial accounting. The outcomes of all transactions of finance in a business are recorded in a business sheet known as a balance sheet, statement of cash flows, and profit and loss statement.

- Cost Accounting: Cost accounting assists an organisation in determining the cost of a manufactured product. It helps the business make cost-effective decisions. The outcome determines how much the product should cost.

- Forensic Accounting: It is an essential branch of accounting that collects, recovers, and restores financial information as a part of the investigation process.

What Are the Concepts of “Accounting”?

Listed below are a few major accounting concepts that need to be understood by every accounting student: –

- When a business organisation’s accounting is completed, a definite separation between the company and the owner is made. All business transactions should be recorded from the perspective of the business rather than the owner.

- It records only those transactions that are recorded and measured in monetary terms.

- Accounting for the fiscal period is required by a business. The period for drawing financial statements varies from monthly to quarterly to, finally, annually. It helps to identify changes that occur over different periods.

- The transactions are recorded as they occur, not as the cash is received.

- Every transaction has two aspects: debit and credit cards. The organisation has to record every transaction affecting both credit and debit cards.

What Are the Basic Accounting Fundamentals?

There are three fundamentals of accounting: assets, liabilities, and owner’s equity. A brief explanation of all of them is below: –

- Assets: Assets are the items that belong to you, and you are the owner of them. It has value and gives you cash in exchange for it.

- Liabilities: Anything owned by an individual is known as a liability. Even a loan you take from a bank to buy any asset is a liability.

- l Owner’s Equity: The total amount of cash someone invests in an organisation is known as owner’s equity.

What Are the Goals of Accounting?

There are various objectives of accounting. Some of them are listed below:

- Accounting keeps track of all the financial transactions of an organisation.

- It becomes easier to maintain the chart showing the organization’s profit and loss through accounting.

- The records report to the firm along with the different activities and timing.

Who Are the External Users of Accounting Information?

There are several users of accounting information in every business:

- Investors: Investors should have an idea of how well the firm with who they have a contract is performing. They rely on financial statements published by companies to examine the profitability, valuation, and risk of investment.

- Creditors: Creditors or lenders study the accounting information of the borrower to find out their ability to repay the loan. They analyse the borrower’s assets and liabilities. They also check the evidence of income and their economic position before they leave the money to the economic entity.

- Trading Partners: Associated trading companies analyse their economic position and then decide whether to trade with other economic entities.

- Law Makers and Economic Planners: The accounting information provides necessary information for making changes to the existing law at the right moment for the improvisation of society and the economy.

Students facing issues with the accounting assignment can seek help with online assignment help services. It would assist them with all the guidelines and strategies to write a good assignment. Every academic write-up has its own professional tone that is followed by the students. It is also mandatory for the assignments to be written in an organised structure. Online services would help assist the students with all the essential guidelines needed to score better. It can also provide a sample draught to increase their comprehension of the structure and format of the write-up and help them earn good grades. When students begin to use online services, they notice a significant improvement in their academic performance. If you want assistance like that, feel free to reach out for accounting assignment help and assure yourself of good grades now.

Business

Mueller Settlement Amazon: Navigating the Legal Landscape

Learn more about the intricacies of the Mueller Settlement Amazon, the consequences for Amazon legally and how it affected the company’s image. Discover the background, the thoughts of experts, and the steps Amazon took to win back customer confidence. Learn all about this retail giant’s struggles, triumphs, and plans for the future.

Introduction

Much attention has been focused on the Mueller settlement with Amazon in the intricate e-commerce industry. This article examines the origins, legal ramifications, and influence on Amazon’s reputation of this deal, among other complexities.

Understanding Mueller Investigation

What is Mueller Settlement Amazon?

A number of Amazon’s business activities were the subject of the inquiry that led to the Mueller settlement. To fully realise the implications of the settlement, it is vital to understand where this inquiry came from.

Significance of the Settlement

Understanding the settlement’s utmost significance in the business realm requires delving into the conclusions of the Mueller investigation and Amazon’s participation.

Legal Implications

Mueller Report Overview

A synopsis of the Mueller report explains the complex legal landscape that Amazon faced. To grasp the seriousness of the settlement, it is necessary to unravel the main conclusions and what they mean.

Amazon’s Legal Responses

In responding to the claims made in the Mueller report, Amazon’s legal staff was helpful. In this part, we will take a look at the methods Amazon used to protect its interests.

Settlement Details

Terms and Conditions

To further understand what Amazon was required to do, it is helpful to review the settlement agreement’s terms and conditions. Understanding the breadth of the settlement requires uncovering the financial ramifications for Amazon.

Impact on Amazon’s Reputation

Public Perception

Public opinion may have just as much of an effect as a court of law. It is instructive to compare popular opinion of Amazon before, during, and after the settlement.

Media Coverage

The media’s coverage of the Mueller settlement was essential in establishing its narrative. The impact on Amazon’s reputation as a result of the media attention is examined in this section.

Amazon’s Response Strategy

Communication Tactics

It takes finesse to communicate at a settlement. To make sense of what happened next, you had to know how Amazon strategically conveyed its position.

Changes Post Settlement

After the payment, Amazon made certain adjustments to fix its reputation. Taking a look at these adjustments shows how seriously the organisation takes the idea of learning from the mistake.

Lessons Learned

Corporate Responsibility

Many people started talking about corporate accountability after the Mueller deal. In this part, we’ll look at what other companies, including Amazon, have learnt.

Future Implications for Companies

Companies may learn a lot about how to deal with future problems like this by looking at the bigger picture of how the settlement affected their actions.

Expert Opinions

Legal Experts’ Take

Views on the Mueller settlement were expressed by legal professionals. Gaining insight into their viewpoints enriches the examination.

Business Analysts’ Perspectives

Analysts from the business world provide light on the potential financial consequences. Gaining insight into their viewpoints allows for a more complete picture to be painted.

Mueller Settlement Amazon: A Timeline

Key Events

To make sense of what’s happening, it’s helpful to go over the major points of the Mueller deal in chronological order.

Milestones in the Settlement

Readers may easily follow the events that had place by locating key points in the settlement chronology.

Consumer Trust Regained

Measures Taken by Amazon

Amazon did some things to win back the confidence of its customers. By breaking down these steps, we can see how seriously the business takes its consumers’ needs.

Customer Feedback

It is critical to pay close attention to what customers have to say. To gauge the success of Amazon’s campaigns, it is helpful to examine consumer comments made after the settlement.

Positive Outcomes

Changes in Corporate Practices

As a result of the Mueller settlement, Amazon revised and updated certain of its business policies. Looking at these developments highlights the benefits of the settlement.

Industry-wide Impact

Beyond Amazon, the settlement’s effects were felt. The effects of the settlement on the industry as a whole are discussed in this section.

Challenges Faced

Internal Struggles

Both during and after the settlement, Amazon encountered difficulties internally. The larger story gains depth from an appreciation of these challenges.

External Backlash

Amazon faced criticism from other sources. Managing a company’s reputation after a settlement is complicated, but it becomes clearer when you look at the external issues.

Success Stories Post Settlement

Amazon’s Growth

The fact that Amazon has continued to grow since the settlement shows how resilient the corporation is. A positive outlook might be gained by delving into this growth tale.

Positive Repercussions

One way to look at the bright side of things is to consider the good things that have come out of the settlement.

The Future of Amazon

Sustainability Efforts

After the settlement, Amazon made sustainability an even bigger priority. By delving into these initiatives, we can better understand the firm’s dedication to ethical business practices.

Ongoing Commitment

The commitment of Amazon to learning from the settlement and making wise adjustments will determine its future.

Conclusion

Last but not least, the path to a Mueller deal with Amazon has been one of profound change. To better overcome obstacles, organisations would do well to understand the legal, reputational, and operational ramifications.

FAQs

Is the Mueller settlement a setback for Amazon’s growth?

Amazon overcame obstacles presented by the settlement and continued to develop as a result.

How did the public react to the settlement?

Both proponents and detractors of the idea voiced differing views in response to the public outcry.

Were there long-term consequences for Amazon?

Improvements in corporate responsibility and shifts in business practices were among the long-term effects.

Business

10 Top Photo Tiles, Wall Art, and Canvas Prints Companies

Introduction

In today’s digital age, we capture countless moments with our cameras and smartphones, but often these memories remain trapped in the digital realm. Fortunately, there are companies that specialize in turning your cherished photos into stunning pieces of art that you can proudly display in your home. From photo tiles to canvas prints, these companies offer a wide range of options to transform your memories into beautiful decor. In this article, we’ll explore the top 10 companies that excel in this field, with special mention to Wallpics, a standout choice.

-

Shutterfly

Shutterfly has long been a household name in the world of personalized photo products. They offer an array of options, including canvas prints, framed prints, and acrylic prints, allowing you to transform your photos into elegant wall art. Shutterfly’s user-friendly website and customization tools make it easy to create personalized pieces that suit your style.

-

CanvasPop

CanvasPop is known for its high-quality canvas prints. They use premium materials and advanced printing techniques to ensure your photos are reproduced with vivid colors and sharp details. CanvasPop offers a range of customization options, allowing you to choose the perfect size and frame to match your decor.

-

Mixtiles

Mixtiles specializes in photo tiles, making it easy to create a unique wall display. Their peel-and-stick tiles are not only convenient to install but also offer a modern and sleek look. You can rearrange them easily, ensuring your wall art is always fresh and appealing.

-

Printique

Formerly known as AdoramaPix, Printique is a trusted name in the world of photography. They offer a variety of printing options, including canvas prints and metal prints, all of which are known for their exceptional quality. With Printique, you can be confident that your photos will be turned into beautiful works of art.

-

Easy Canvas Prints

As the name suggests, Easy Canvas Prints makes the process of creating canvas prints a breeze. Their user-friendly website guides you through the customization process, allowing you to choose from various sizes, frames, and even image enhancements. The result is stunning canvas art that’s delivered to your doorstep.

-

CanvasDiscount

CanvasDiscount is known for its affordable canvas prints without compromising on quality. They frequently run promotions and offer competitive pricing, making it a budget-friendly option for transforming your photos into canvas art. Despite the lower prices, the quality of their prints remains impressive.

-

Nations Photo Lab

Nations Photo Lab is a professional-grade photo printing service that offers a wide range of products, including canvas prints and metal prints. They are known for their attention to detail and color accuracy, ensuring your photos are faithfully reproduced. Nations Photo Lab is a popular choice among photographers and art enthusiasts.

-

Great Big Canvas

Great Big Canvas specializes in large-format art prints that can make a bold statement in your home. Their collection includes a wide range of styles, from contemporary to classic, ensuring there’s something for everyone. Whether you want to showcase your own photos or explore their vast library of artwork, Great Big Canvas has you covered.

-

Fracture

Fracture takes a unique approach to photo printing by directly printing your images on glass. The result is a sleek and modern look that enhances the vibrancy of your photos. Their minimalist design and easy-to-hang system make it simple to transform your photos into eye-catching wall art.

-

Wallpics

Last but not least, Wallpics deserves a special mention on this list. Wallpics offers a distinctive and creative way to display your photos as wall art. They specialize in photo tiles that can be easily arranged and rearranged on your wall. With Wallpics, you have the flexibility to create your own unique photo collages and arrangements, adding a personal touch to your decor.

Conclusion

Turning your favorite photos into beautiful wall art has never been easier, thanks to the top-notch companies mentioned in this article. From canvas prints to photo tiles, these companies offer a variety of options to suit your style and budget. Whether you’re looking for professional-grade quality or a budget-friendly solution, you can trust these companies to transform your cherished memories into stunning pieces of art. And with Wallpics’ creative approach to photo tiles, you have the freedom to design your own unique wall display that tells your story in a truly personalized way. So, don’t let your precious memories stay hidden on your devices; turn them into beautiful art pieces that you can enjoy every day.

Business

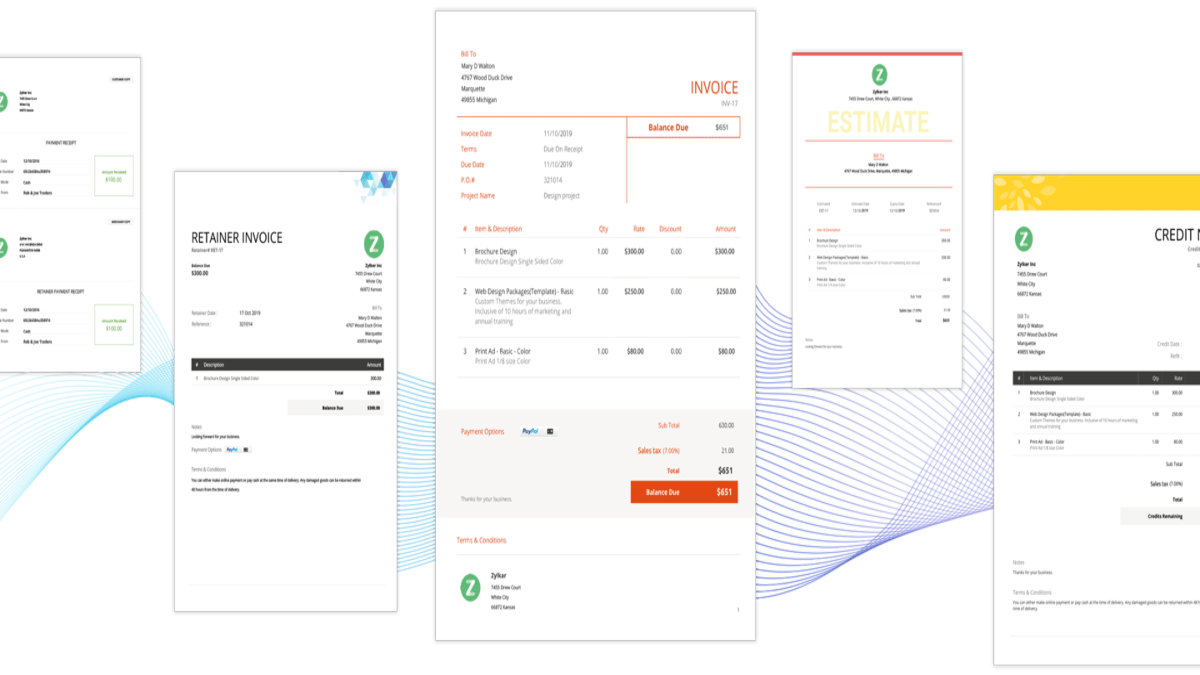

Top 8 Invoice Generator Software for Freelancers, Small Businesses, and Professional Contractors

Introduction:

In today’s rapidly evolving business world, the demand for efficient tools to manage financial transactions and streamline operations has never been greater. Freelancers, small businesses, and professional contractors all require effective invoice generator software to create professional invoices and ensure timely payments. In this article, we present a new list of the top 8 invoice generator software solutions, with a focus on Zintego, an innovative invoicing tool that can revolutionize your billing process.

-

QuickBooks Online:

QuickBooks Online by Intuit is a highly popular cloud-based accounting software suitable for freelancers and small businesses. It offers a robust invoicing module with customizable templates, expense tracking, and online payment capabilities. QuickBooks Online also integrates seamlessly with various third-party applications.

-

Xero:

Xero is another cloud-based accounting software that excels in invoicing. It provides customizable invoices, expense management, and multi-currency support. Xero’s intuitive interface and automation features make it an excellent choice for small businesses and professional contractors.

-

FreshBooks:

FreshBooks is a user-friendly invoicing and accounting software tailored for freelancers and small businesses. It offers automatic payment reminders, expense tracking, and client management. FreshBooks also provides a time tracking feature and supports multiple payment gateways.

-

Zoho Invoice:

Zoho Invoice, part of the Zoho suite of business software, offers comprehensive invoicing features. Users can access customizable templates, time tracking, expense management, and online payment processing. Zoho Invoice integrates seamlessly with other Zoho applications, providing a holistic business management solution.

-

Wave:

Wave is a free invoicing and accounting software ideal for freelancers and small businesses on a tight budget. Despite its cost-free nature, Wave offers essential features such as invoice customization, expense tracking, and secure payment processing. Additional paid add-ons are available for advanced functionality.

-

Hiveage:

Hiveage is an all-in-one invoicing and billing solution designed for freelancers, small businesses, and professional contractors. It offers customizable invoicing templates, expense tracking, and time billing. Hiveage also includes robust reporting features to help users gain insights into their financial performance.

-

Invoice2go:

Invoice2go is a straightforward invoicing software that caters to the needs of small businesses and professional contractors. It provides customizable invoice templates, expense tracking, and online payment acceptance. Invoice2go also offers a mobile app for on-the-go invoicing.

-

Zintego – A Game-Changing Invoice Generator:

Among the top invoicing software options, Zintego deserves special attention. Zintego has rapidly gained recognition for its innovative approach to invoicing. Here are some standout features that make Zintego a valuable addition to this list:

- Smart Automation: Zintego leverages smart automation to simplify the invoicing process. It can automatically generate recurring invoices, saving time and ensuring consistent billing for retainer clients or subscription-based services.

- Customizable Templates: Zintego provides a range of customizable invoice templates, enabling users to create invoices that match their brand identity. You can easily add your logo, adjust colors, and customize the layout to your liking.

- Expense Tracking: The software includes expense tracking features, allowing users to monitor business expenditures effortlessly. Expenses can be categorized, receipts attached, and detailed expense reports generated for better financial management.

- Multi-Currency Support: Zintego understands the needs of international businesses and offers multi-currency support, making it easy to invoice clients in their preferred currency.

- Payment Integration: Zintego integrates seamlessly with popular payment gateways, facilitating online payments and reducing payment delays.

- Client Management: Zintego assists in managing client information, providing quick access to contact details, transaction history, and outstanding balances. This feature is invaluable for maintaining strong client relationships.

- Mobile Accessibility: With the Zintego mobile app, users can create and send invoices from anywhere, ensuring flexibility and efficiency in their invoicing process.

- Data Security: Zintego prioritizes data security by employing encryption and secure protocols to protect financial information, ensuring the utmost confidentiality for users and their clients.

Conclusion:

Invoicing plays a pivotal role in the success of freelancers, small businesses, and professional contractors. The right invoice generator software can simplify invoicing, enhance professionalism, and boost cash flow. While established solutions like QuickBooks Online, Xero, and FreshBooks offer robust features, Zintego’s innovative approach and user-friendly interface make it a compelling choice.

As businesses continue to evolve, having a reliable invoicing tool like Zintego can make a significant difference in managing finances efficiently and nurturing client relationships. Explore these options to find the software that best fits your invoicing needs and helps your business thrive in today’s competitive landscape.

-

Social Media10 months ago

Social Media10 months agoWho is Rouba Saadeh?

-

Apps10 months ago

Apps10 months agoWhy is Everyone Talking About Hindi Keyboards?

-

Social Media10 months ago

Social Media10 months agoMati Marroni Instagram Wiki (Model’s Age, Net Worth, Body Measurements, Marriage)

-

Entertainment10 months ago

Entertainment10 months ago12 Online Streaming Sites that Serve as Best Alternatives to CouchTuner

-

Apps10 months ago

Apps10 months agoThings you need to know about Marathi keyboard today

-

Apps10 months ago

Apps10 months agoStuck with Your default Bangla keyboard? Isn’t it time for a change?

-

Entertainment10 months ago

Entertainment10 months agoMovierulz Website: Movierulzz 2021 Latest Movies on Movierulz.com

-

Social Media10 months ago

Social Media10 months agoBrooke Daniells: Everything About Catherine Bell’s Partner